Bullion bars have long captivated the attention of investors, collectors, and even governments as a reliable store of value and a tangible representation of wealth. These gleaming bars, often made from pure gold or silver, are among the most sought-after forms of investment in the precious metals market. In this article, we delve into the world of bullion bars, exploring their history, significance, and why they remain a popular choice for those looking to secure their financial future.

What Are Bullion Bars?

Bullion bars are refined precious metal bars that are valued primarily for their metal content, rather than any numismatic or historical significance. They are typically made from gold, silver, platinum, or palladium and are bullion bars cast or minted into bars of various sizes and weights. The most common metals for bullion bars are gold and silver, with gold bars being the most widely recognized and traded.

A Brief History of Bullion Bars

The use of precious metals as a form of currency and wealth storage dates back thousands of years. Ancient civilizations, such as the Egyptians and Romans, utilized gold and silver in trade and as a means of storing wealth. The modern concept of bullion bars, however, began to take shape in the 19th century, when large quantities of gold and silver were refined and cast into standardized bars for ease of trade and storage.

Bullion bars became particularly important during times of economic uncertainty, as they provided a stable and secure form of wealth that could be easily transported and stored. Governments and central banks began accumulating bullion bars as part of their reserves, further solidifying their role as a cornerstone of the global financial system.

Why Invest in Bullion Bars?

Tangible Asset: Unlike stocks, bonds, or digital currencies, bullion bars are physical assets that you can hold in your hand. This tangibility gives investors a sense of security, knowing that they own a piece of valuable metal that is not subject to the fluctuations and risks of the financial markets.

Inflation Hedge: Gold and silver bullion bars are often seen as a hedge against inflation. When the value of fiat currencies declines due to inflation, the value of precious metals tends to rise, preserving the purchasing power of the investor’s wealth.

Portfolio Diversification: Including bullion bars in an investment portfolio can provide diversification, reducing overall risk. Precious metals often move inversely to other asset classes, such as stocks and bonds, making them a valuable addition to a well-rounded investment strategy.

Liquidity: Bullion bars are highly liquid assets. They can be easily bought and sold on the global market, and their value is universally recognized. This makes them an ideal choice for investors who may need to quickly convert their assets into cash.

Global Acceptance: Bullion bars, particularly gold bars, are accepted and bullion bars valued worldwide. This global recognition ensures that investors can trade or sell their bullion bars in almost any country, providing a level of flexibility not found with other types of investments.

Types of Bullion Bars

Bullion bars come in a variety of sizes, from small 1-gram bars to large 1-kilogram bars, and even larger. The most common sizes are:

- 1-ounce bars: Popular among individual investors for their affordability and ease of storage.

- 100-gram bars: A mid-sized option that offers a balance between size and value.

- 1-kilogram bars: Favored by serious investors and institutions for their high value and lower premiums per ounce.

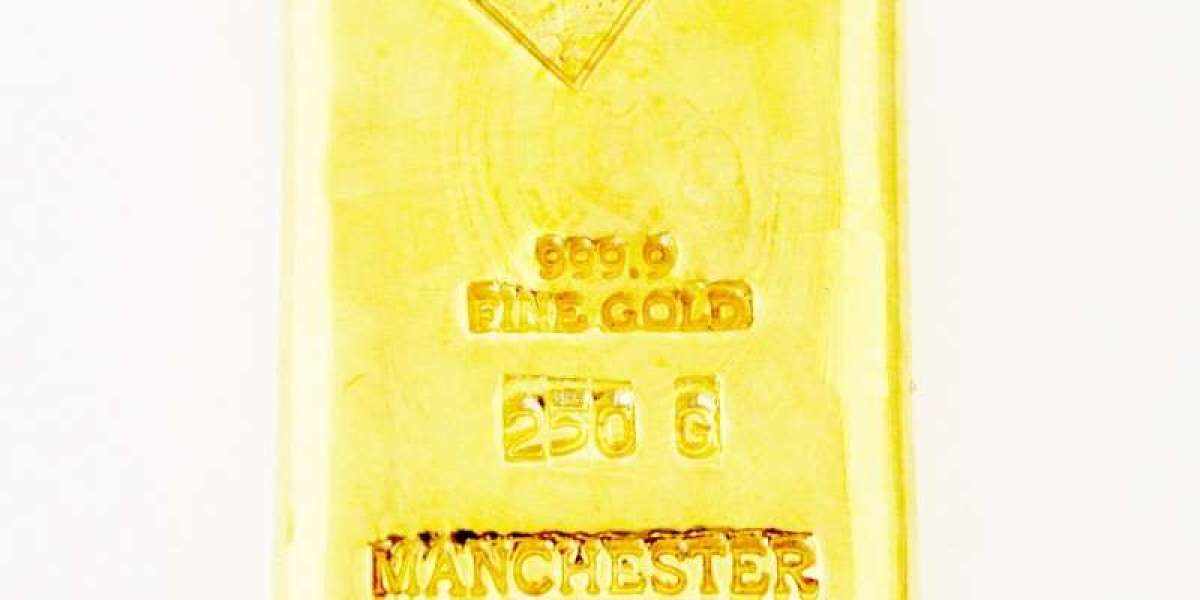

Gold bullion bars are typically stamped with the purity of the gold (usually 999.9, or 24 karat), the weight, and the mint or refiner's mark. Silver bullion bars, while also highly pure, are often stamped with their weight and purity, and sometimes a serial number for added security.

The Future of Bullion Bars

As economic uncertainty continues to loom, the demand for bullion bars remains strong. Central banks continue to accumulate gold bullion as part of their reserves, and individual investors are increasingly turning to precious metals as a safe haven for their wealth. The growing popularity of digital gold and silver trading platforms has also made it easier for investors to buy and sell bullion bars, further increasing their appeal.

In conclusion, bullion bars represent a timeless and reliable investment option. Whether you’re a seasoned investor looking to diversify your portfolio or a newcomer seeking a stable and tangible asset, bullion bars offer a wealth of opportunities. Their enduring value, global recognition, and ability to act as a hedge against economic instability make them an essential part of any investment strategy.

Visit Us :https://www.a1mint.com/